The Internet's Gold: How Bitcoin Endures Broader Market Liquidations!

We just witnessed the biggest crypto liquidation ever! It's a blip in the grand scheme of things. Here's why...

You might've noticed that folks usually don't get super serious about Bitcoin until…

They dig deep enough and really understand why it’s the reserve asset of the internet economy (I unpacked that last week).

Once your friends, family and close colleagues grasp how Bitcoin is gonna shape the future of money, you're not just betting on a hot stock – you're in it for the long haul. That means you can ride out those wild price swings and ignore all the noise from the media.

It's all about seeing the bigger picture!

But first, let me highlight the last 24 hours… As reported by Sylvain:

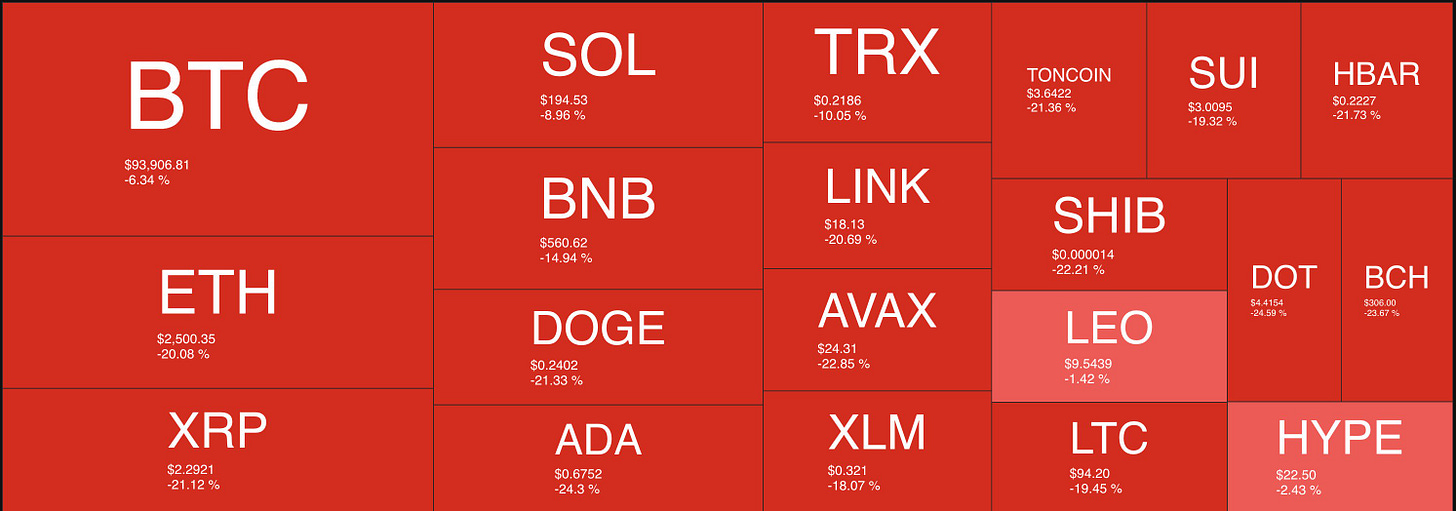

We just witnessed the biggest 1-day liquidation in crypto history.

$800 BILLION of market cap was lost in a matter of hours and total liquidations hit $2 billion.

Not even the collapse of FTX or March 2020 saw liquidations like this.

The question, then, is this:

What does that slice of time, over the last 24-hours, mean for the Bigger Picture?

Over to friend Wayne Shirreffs for some perspective:

Yep, we just witnessed the biggest crypto liquidation ever!

Alt-coins bled 30-40% and panic selling was everywhere last night.

But wait…

Is this really game over?

OR

Is this just another wild shake out before we rocket to Valhalla?

Everyone thought Big T getting into office would pump our bags, right?

So what gives?

This dump isn't about crypto at all, that's what.

It's all about what's happening in the global money game.

Then some market makers also taking advantage and doing what they always do. Liquidating billions of dollars from crypto holders using leverage (bad idea).

Let's break it down.

The Tariff Tornado that hit over the weekend.

The White House dropped a bomb over the weekend.

25% tariffs on Canada and Mexico.

10% on China.

Why?

They're playing hardball on immigration and that fentanyl crisis.

These tariffs won't last, they are just a negotiating tool. (More from Pomp here…)

And they are already working, as Big T just agreed to pause the tariffs on Mexico after a call with Mexican president Claudia Sheinbaum earlier today.

Bear’s Note: For my riff on the human condition that likes to critique Trump’s “assertive style,” see my latest flakebook post here…He [Trump] did this because she agreed to immediately send 10,000 Mexican Soldiers to the border between the U.S. and Mexico to stop the inflow of illegals (and drugs).

While the tariffs kicked our crypto bags in the nut sack — they [also] worked as expected.

They were used as leverage in a negotiation to secure our borders and make our country safer.

But here's where it gets spicy overall…

Canada clapped back with matching 25% tariffs.

Mexico and China were cooking up their own revenge tariffs.

Oh, and that BRICS crew?

They were threatened with 100% tariffs by us if they dare to create their own currency.

Brutal.

Here's the thing about tariffs that most folks don't get:

They're straight-up inflation fuel. When U.S. companies have to pay more to import stuff, guess who ends up eating that cost?

Yep, you and me.

Higher prices = inflation = Fed goes hawk mode with rate hikes.

And we all know what that does to crypto.

The Numbers Are Nuts: We're talking MASSIVE trade relationships here:

Canada: $1 trillion yearly

Mexico: $800 billion

China: $600 billion

When you slap tariffs on everything from Canadian oil to Mexican avocados, prices are going to soar.

And now they're eyeing the EU too? No wonder the market just had a heart attack.

The Silver Lining:

But check this out — most crypto (except ETH) is still in bull territory.

This record-breaking $2B liquidation?

We've seen this movie before — COVID crash, FTX disaster, Yen carry trade mess.

Each time, it marked a bottom before the next rally.

Sure, we might bounce around for a few weeks. But there's still so much rocket fuel in the tank.

Lots of catalysts still aren’t priced in:

ETH ETF staking coming

U.S. Crypto Strategic Reserve

Banks finally joining the party

Altcoin ETFs on deck

Look, I get it. Watching your portfolio drop 40% in a day feels like getting punched in the hairy boys repeatedly.

But this is crypto, and it is not for the faint of heart.

When this market decides to rip higher again (and it will), it's going to melt faces.

My advice?

(Not Financial Advice)

Don't panic sell at the bottom, and don’t use leverage so that you get liquidated during quick shake out events like this…. Especially with institutions and nations states now buying your Bitcoin.

Maybe take a break and don’t look at your portfolio for a bit.

Or better yet, grab those gonads and use it as an opportunity to buy more of the best-performing asset on earth: Bitcoin.

We've been here before, and the strongest hands always win.

Trust me, when this turns around, you'll wish you'd bought more at these prices.

2025 is still going to be a monster year for Bitcoin (and crypto)

Back to yours truly…

If you haven’t yet read my latest Opportunity Alert (#4), it couldn’t be a better time to dive in… and… take action:

Barry, did you write this or did someone else?

You've lost me as a subscriber because of this promotional hype.