The conversation, lately, has been going something like this:

FOMO person: I’m kicking myself in the ass for not riding the bitcoin train when I first heard about it!!

Me: Aren’t we all!

FOMO person: Maybe it’ll dip in price, soon?

Me: Yes, that’s the nature of pricing, across all markets.

FOMO person: I don’t want to get back in until it, say, goes down to $80k again!

Me: What says it ever will hit that level? It’s a scare, sought-after decentralized monetary asset with a fixed supply. What if you have to wait several months? Or never? Also, is that what you said to yourself when it was $60k — that you don’t want to buy more until it, oh I dunno, say, hits $50k?

FOMO person: Okay, okay…. I get your point. Stop being a grizzly bear about it!

Eventually…. I just get impatient… and ask them to go to hope.com (seriously), then for them to get back to me with any questions.

For anyone who does decide to, after at least a few hours on that website, 9 times out of 10… the conversation then goes like this:

HODL person (once FOMO’d): I get it now! BTC’s value proposition goes beyond price!

Me: Yup!

HODL person: That hope.com site is Michael Saylor focused. Still, it opened my eyes.

Me: I, personally, respect and follow people who put their money where their mouth is. It’s amusing to me that we’ve been conditioned to use a government-backed currency — fiat, in the form of dollars or Euros; currencies that erode our purchasing power over time — yet some people will still ‘sit on the fence’ when it comes to a currency, Bitcoin, that inherently preserves purchasing power!

HODL person: Yes, makes sense now. One of the resources on that site covered all the recent institutional demand for it. And I heard how VanEck’s CEO, Jan van Eck, suggests Bitcoin could potentially capture half the market share of gold, leading to a $300,000 price target!

Me: Without question, like the Internet itself in the late 90s, we’re still in the very early adoption stage with $BTC. But, again…. That word “price.” Let’s remove it from our head jargon.

Why?

If you’ve read my full answer to Q&A #5, then you already know I don’t view BTC as an investment, as much as I do conveniently-liquid “online money.” No matter what the price is, it just makes sense, as a sound money-management practice, to dollar-cost-average (DCA) into it, in whatever fiat-to-BTC schedule you can handle.

When you DCA into it, you’re taking the emotion out of your fiat-to-BTC purchases. You’re automating recurring buys, making it a "set it and forget it" strategy. It removes the need for constant market monitoring and decision-making. And you’re reducing exposure to short-term price fluctuations, as you buy at various price points.

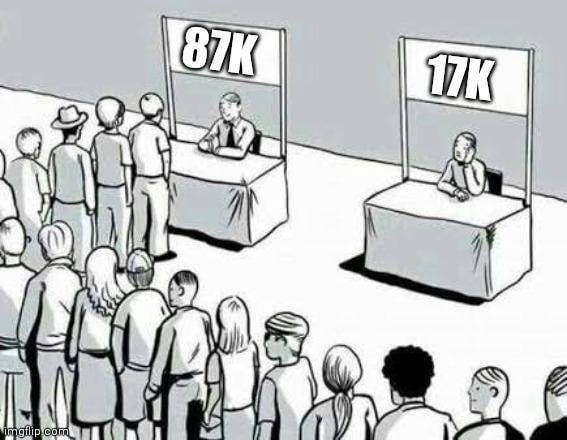

It looks like this:

In short…

Just like you probably did, I also thought it was “too late” to buy Bitcoin when it first reached $1,000. Then, when it hit $10,000. Then $20,00. And then $40,000! See where I’m going with this?

It’s a superior asset for the digital age — easily transferrable, verifiable, an emerging medium-of-exchange, borderless, censorship-resistant, and without the physical limitations of gold. To be clear, it’s potential market cap could far exceed that of gold, suggesting much higher valuations per Bitcoin.

Speaking of gold, I even showed my cherished Pro subscribers how to use $BTC to purchase precious metals online. Yes, I still advocate for gold exposure (but minimally compared to $BTC).

More about where I DCA, as shown above.

It’s simple: Swan Bitcoin.

I first heard about Swan from Lyn Alden. Here’s a brief summary, from her:

Swan Bitcoin isn’t a crypto exchange. It’s a bitcoin accumulation platform, with options for both one-time purchases and recurring purchases (dollar-cost averaging plans). It works easily on both a desktop device or mobile device. And they provide a full suite of other bitcoin-related services.

Fees will be 0.99% on your purchase. They don’t take a spread on the purchase, either. Some “no fee” platforms take a spread. And importantly, the first $10k USD worth of bitcoin purchases have zero fees.

With Swan, you can auto-withdrawal to your own self-custody address for free, or you can keep it with Swan’s custodian for free and access it through them, with the bitcoin held in your name. The cool combo, then, is that you can set up a dollar-cost average plan that automatically buys bitcoin regularly, and then also regularly sends it to your hardware wallet or other custody solution.

I, your transparent Bear, have been personally using them for just over a year.

Here’s the rundown:

Bitcoin-focused: Unlike Coinbase, Swan specializes exclusively in Bitcoin, not offering other cryptocurrencies.

Emphasis on self-custody: Swan strongly encourages users to withdraw their Bitcoin to self-custody as soon as possible after purchase.

Custodial options: While Swan does offer custodial services through partners like Fortress Trust, Bakkt, and BitGo, they emphasize this as a temporary solution.

Swan Vault: They provide an intuitive self-custody solution called Swan Vault, which uses a 2-of-3 multisig setup. This allows users to maintain direct ownership of their coins through private keys held locally.

Education: Swan places a strong emphasis on educating users about Bitcoin and self-custody practices. YouTube | Blog

Purchasing services: Swan offers Bitcoin purchasing services with options for automated recurring buys (dollar-cost averaging).

Additional services: They provide solutions for individuals, high net worth clients, businesses, and retirement accounts.

🗒️ NOTE to my Pro subscribers:

Nichole & I love Swan. They are a world-class operation, headquartered in Calabasas, California and run by CEO Cory Clippstein. So, soon, I will provide you a complete screencast walkthrough video on how to use the Swan Bitcoin platform.

In the meantime, you can sign-up here….

ℹ️ Related Posts:

ℹ️ Crypto / BTC Substack Resources I recommend:

When you study BTC and choose to DCA, remember to study UTXO management too. :) Ben Perrin at BTC Sessions https://www.youtube.com/@BTCSessions/search?query=utxo and Matthew Kratter at Bitcoin University https://www.youtube.com/@Bitcoin_University/search?query=UTXO both have great information about this.