Borrow Strong, Pay Back Weak

The counterintuitive strategy wealthy families use every generation

🐻 THE MELTING DOLLAR & THE RISE OF GOOD DEBT

Why Long-Term Debt Is Quietly Becoming the Most Mispriced Asset in America

TL;DR (Too Long; Debt Rising 😏)

The dollar is melting. Debt is melting with it. Real assets aren’t.

Long-term, fixed-rate debt is becoming one of the most valuable financial tools in the modern era—if used to acquire real, productive, cash-flowing assets that outrun inflation.

🧊💸 The Melting Dollar: A Wealth Secret Hiding in Plain Sight

If you want to understand how wealth is built in today’s financial system, here’s the uncomfortable truth:

The U.S. dollar is melting.

Your debt is melting with it.

But the right assets aren’t.

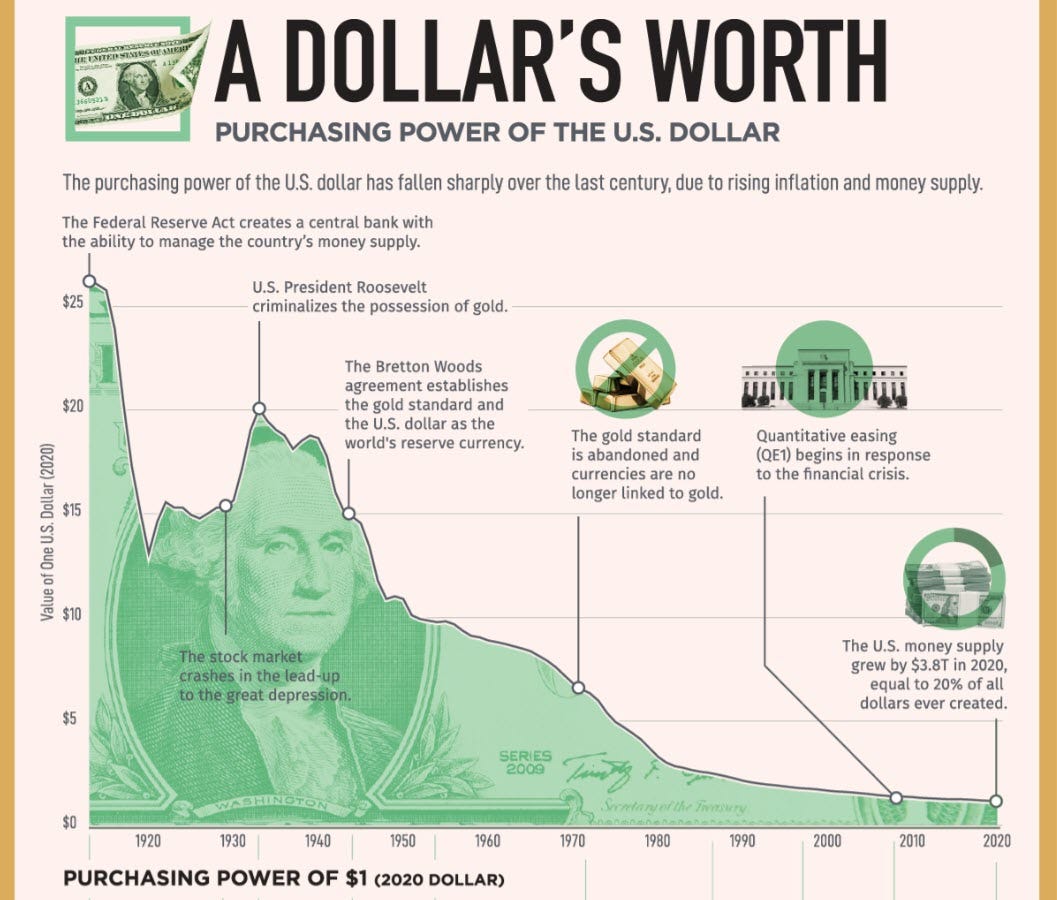

That century-long chart above?

It’s not a historical artifact.

It’s the playbook.

Over the last 100 years, the purchasing power of the dollar didn’t decline by accident. It declined by design. When you run the world’s reserve currency on an endlessly expandable money supply, you get predictable consequences.

This is not emotional.

It’s mathematical.

And today, I’m sniffing out one of the most under-discussed wealth levers in the modern financial game.

Once you understand the rules, you can finally start winning the game instead of getting played.

⚠️📉 “Long-Term Debt Is Dangerous!”

…says everyone who hasn’t run the numbers!

People panic over 40-year and 50-year mortgages.

“Scam!”

“You’ll pay forever!”

“My grandpa would roll over in his grave!”

Sure.

Maybe grandpa would.

But the truth?

Long-term, fixed-rate debt in a debasing currency is one of the most powerful wealth tools ever created.

Not if you spend it foolishly.

Not if you buy liabilities.

Not if you’re financing ego purchases.

But used strategically?

To buy real, productive, cash-flowing assets?

Debt becomes a weapon.

🔥💵 The Hot-Potato Dollar

My friend Wayne Shirreffs put it beautifully:

“Your parents’ playbook? Dead.

Your grandparents’ strategy? Ancient history.

Money is getting debased faster and faster — and they WILL print more.”

Here’s what most people never connect:

If the government must print more,

then the dollars you owe in 20–50 years are worth FAR less than the dollars you borrow today.

You borrow strong dollars.

You pay back weak dollars.

The bank holds the ice cube while your assets appreciate.

This isn’t a glitch.

It’s the system.

And wealthy families have been exploiting it for generations.

📉🧮 Inflation = The Silent Debt Killer

Let’s anchor this with simple math:

$100 in 1950 → $13.92 in 2000

$1 in 1920 → ≈ $0.03 today

The dollar has lost 95%+ of its purchasing power since 1925

So yes, a $500k or $1M mortgage seems big today.

But in 30–50 years?

It will feel like paying off a used 2005 Honda Civic.

Meanwhile, the assets you bought with that debt?

Those keep pace with inflation — or outrun it.

Time + inflation = your debt vaporizing

Time + appreciation = your assets multiplying

That spread is where real wealth lives.

📈🏠 So… What Should You Buy With Melting, Cheapening Dollars?

This is where people freeze.

The wealthy don’t.

They convert melting currency into strong assets that grow while the currency shrinks.

Buy assets that:

Outrun inflation

Throw off income

Appreciate over time

Can be owned outright while your debt quietly evaporates

Examples:

Real estate

Productive businesses

Hard digital assets with capped supply

Cash-flowing nodes + mining infrastructure

(you know exactly where I’m going with this…)Any asset that compounds while the dollar decays

These are the things that survive inflationary environments.

That thrive because of inflation.

Not despite it.

When money melts, assets matter.

📊🚀 Tim Denning: The Real Killer Is Asset Inflation

Tim Denning nailed it when he wrote:

People think I love stocks or crypto because it’s cool.

No. It’s because of hidden inflation — asset inflation.

Most people worry about milk and gas.

But the real monster?

Asset prices.

When the Fed printed 40% of all dollars (2020–2021), those dollars didn’t drift into the air.

They flooded into:

Real estate

Equities

Digital assets

Commodities

Private businesses

If you didn’t own assets, you fell behind.

Even if you worked hard.

Even if you saved “responsibly.”

Savers sink.

Owners rise.

That simple.

📘💡 Dalio’s Test: One Question Decides It All

Ray Dalio says there’s only one question that determines whether debt is good or bad:

Will the debt help you earn more (or save more) in the future?

If yes → good debt

If no → bad debt

Bad debt =

Credit cards

Luxury cars

Low-ROI degrees

Good debt =

Cash-flowing real estate

Productive businesses

Capped-supply digital assets

Infrastructure that prints yield

Mining nodes and digital computation

Debt that produces is good.

Debt that consumes is bad.

Simple.

🛠️📘 The Strategy (Bear Edition)

Let’s strip out the fluff.

This is the simplest modern wealth equation you’ll ever see:

1. Borrow long-term, fixed-rate debt

Inflation destroys it.

2. Buy real, productive, cash-flowing assets

Not toys. Not flexes. Not liabilities.

3. Hold. Through. The. Noise.

Math outlasts headlines.

4. Let inflation vaporize your debt

This is guaranteed.

5. Let your assets outrun the dollar decay

This is where people quietly build real wealth.

That’s it.

That’s the playbook.

🐻 Bear’s Bottom Line

You can fight the system emotionally…

Or understand it mathematically.

The dollar is being debased.

Debt tied to that dollar is being debased.

But the assets you buy with that debt?

They aren’t melting — they’re multiplying.

This era is not about saving.

It’s about positioning.

And the people who learn to turn weak money into strong assets will walk into the next decade with freedom, optionality, and a portfolio that pays them every day…

…while everyone else complains about prices.

Play the new game.

With the new rules.

And let time do the heavy lifting.

Your Partner in the Quest for

Living a Life Without Limits,

Barry “Bear” Goss

🔗 P.S.

If you want to see one of the most misunderstood, early-stage, real-world asset systems being built right now — the kind that throws off daily yield while the dollar melts — start here:

https://bearsbulletins.substack.com/s/texit

(Just look with curiosity. Not obligation.)