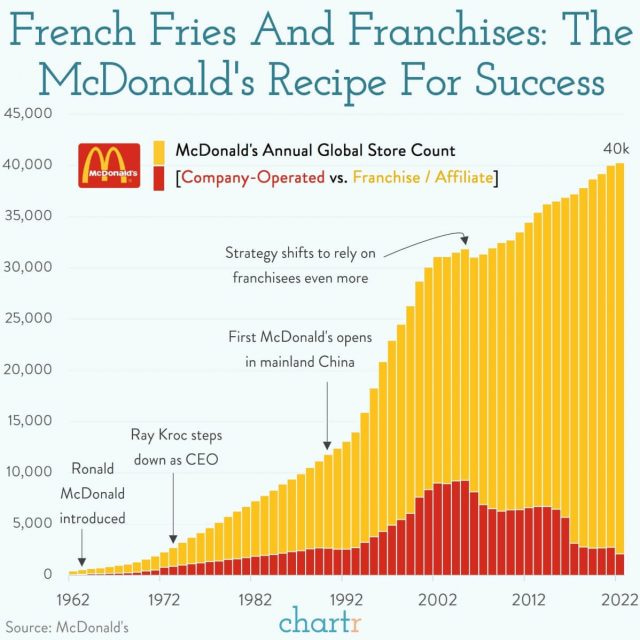

French fries and franchises: The 'Wuda-Cuda-Shuda' of long-term stock investing

And a reminder as to why there’s a wealth of immense opportunity, major ROI possibility, outside the equities market.

If you’re new to my little Bear-den community….

Then you may not know, for well over a decade, my focus has been to participate in off-the-beaten-path opportunities, alternative investments.

Back in 2009, when Brad & I started tossing around the idea of teaming up, I was deep in the bowels of the currency / FX markets… alongside building out what I liked to call my ‘future budding happy meals.’

Meaning, those human-capital empowered companies where the fuel is problem-solving, ambition, and the quest for disruption.

The result, over time (more likely than not) was major, major appreciation in their stock price.

In the case of some products, as friend Tim Knight points out in the image caption below, let’s just say they’re not always for “healthy” consumption.

Still, they thrive — at least, in the land of the obese and short-lived.

And, yes, Micky-D’s, like Amazon, was rare in the sense that it was spearheaded by a “founder” with a passionate / creative-thinking drive.

Speaking of the latter, I picked up (not enough) shares of Amazon (AMZN) back in 2001, because I saw a company literally re-writing e-commerce. And… The way we can satisfy our need for instant-gratification.

In similar 20-20 hindsight, do I wish I was old enough back in 1981 to be able to predict Home Depot’s (HD) major rise to stardom… Where $5000 invested in Home Depot, at its IPO, would be worth $30 million today (inclusive to stock spits and dividends reinvested)?

Yes, of course.

Not that I would have “seen” it’s future, or even cared at 12 years of age. But, since then, after years of being in the trenches of consumerism, trend-watching and rule-breaking (i.e., changing old habits and ways to garner more leveraged results, regardless of how controversial it is)…

I can confidently offer two valuable pieces of profitable wisdom: